Income tax calculator biweekly

Your average tax rate is. A salary or wage is the payment from an employer to a worker for the time and works contributed.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

That means that your net pay will be 45925 per year or 3827 per month.

. Your average tax rate is 270 and your marginal tax rate is 353. The 2022 tax values can be used for 1040-ES estimation planning ahead or. That means that your net pay will be 35668 per year or 2972 per month.

How to calculate Federal Tax based on your Weekly Income. Estimate your federal income tax withholding. Effective tax rate 172.

That means that your net pay will be 40568 per year or 3381 per month. That means that your net pay will be 43041 per year or 3587 per month. Ad Discover Helpful Information And Resources On Taxes From AARP.

Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. Effective tax rate 561.

Use Our Free Powerful Software to Estimate Your Taxes. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. To protect workers many countries enforce minimum wages set by either central or local governments.

Your average tax rate is. All bi-weekly semi-monthly monthly and quarterly figures are derived from these. If you make 55000 a year living in the region of Florida USA you will be taxed 9076.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. New York state tax 3925.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. That means that your net pay will be 37957 per year or 3163 per month. Total income tax -12312.

Income Tax Withholding. It can also be used to help fill steps 3 and 4 of a W-4 form. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

If you make 52000 a year living in the region of Manitoba Canada you will be taxed 16332. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Related Take Home Pay Calculator Income Tax Calculator.

And is based on the tax brackets of 2021 and 2022. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Marginal tax rate 633.

Enter your info to see your take home pay. Use this tool to. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

See What Credits and Deductions Apply to You. It is mainly intended for residents of the US. See how your refund take-home pay or tax due are affected by withholding amount.

Ad Enter Your Tax Information.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Paycheck Calculator Online For Per Pay Period Create W 4

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

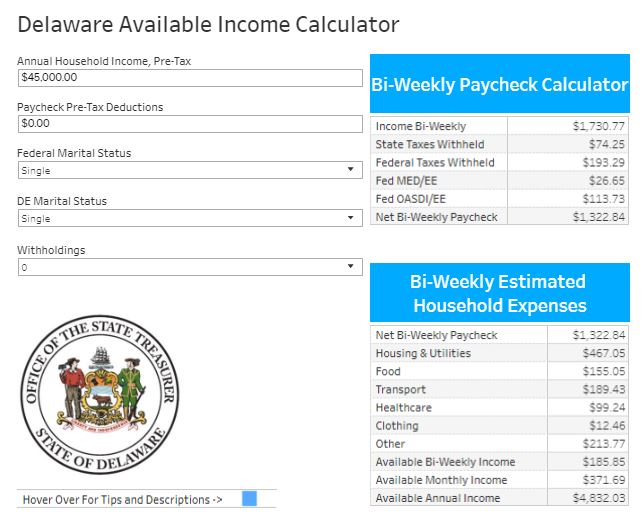

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware

How To Calculate Payroll Taxes Methods Examples More

Free Payroll Tax Paycheck Calculator Youtube

Paycheck Calculator Take Home Pay Calculator

New York Paycheck Calculator Smartasset

Ready To Use Paycheck Calculator Excel Template Msofficegeek

How To Calculate Federal Income Tax

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

Paycheck Calculator Take Home Pay Calculator

Free Paycheck Calculator Salary Pay Check Calculator In Usa

Smartasset Paycheck Calculator Online Offers 59 Off Ceasuristradale Ro

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Template Download Printable Pdf Templateroller

Free Online Paycheck Calculator Calculate Take Home Pay 2022